LCL is a French bank that offers banking services to individuals, professionals, businesses, and institutions. LCL is part of the Crédit Agricole group, one of Europe's leading banking and insurance groups.

If you are an LCL Personal Banking customer , you can access your accounts online at lcl.fr. This service allows you to view your balance, transactions, statements, cards, loans, insurance policies, investments, and contracts. You can also make transfers, payments, request checkbooks, stop payments, run simulations, and subscribe to new services.

In this article, we will explain how to connect to your LCL Personal accounts on lcl.fr , what the advantages of this service are and how to resolve any connection problems.

How do I log in to my LCL Personal accounts on lcl.fr?

To log in to your LCL Personal accounts on lcl.fr, you must follow these steps:

- Visit the website ( https://www.lcl.fr/compte-bancaire/mon-espace-connecte-client ) from your computer, tablet or smartphone.

- Click on the “My space” button in the top right corner of the homepage.

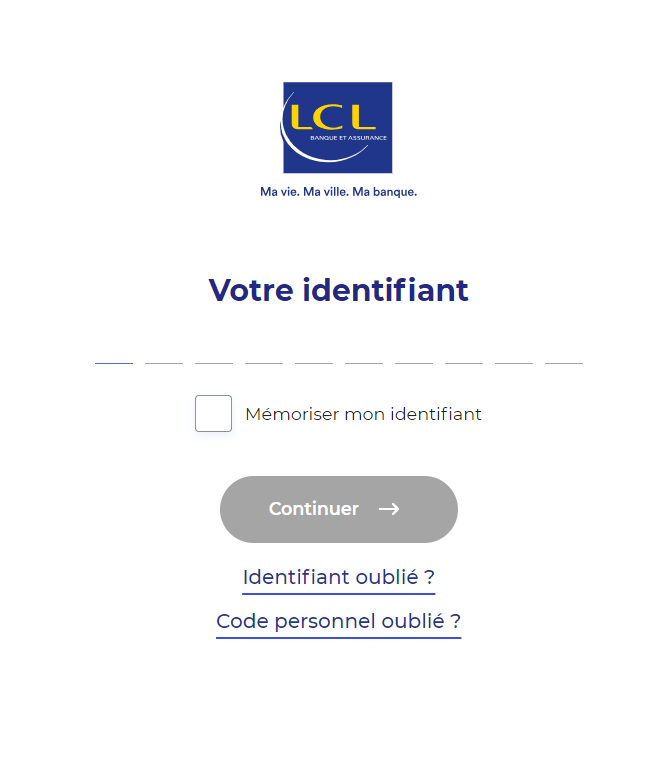

- Enter your username and password in the corresponding fields. Your username is 10 digits long and your password is 6 digits long. You received these by mail when you signed up for online banking.

- Click the “Validate” button to access your customer area.

You can also access your LCL Personal accounts from your smartphone or tablet by downloading the LCL My Accounts app from [ Google Play ] or [ App Store ]. You will then need to enter the same login details as on the website.

What are the advantages of logging into your LCL Personal accounts on lcl.fr?

Logging into your LCL Personal accounts on lcl.fr offers several advantages:

- You can manage your accounts anytime, from anywhere, 24/7.

- You can benefit from an overview of your financial situation and the products you have subscribed to with LCL .

- You can carry out routine transactions in just a few clicks , without having to go to a branch or call your advisor.

- You can take advantage of exclusive services , such as personalizing your bank card, managing your budget, setting up SMS or email alerts, or accessing special offers.

- You can secure your online transactions with the 3D Secure system , which requires you to confirm each payment with a code received by SMS or push notification.

How to resolve connection problems with your LCL Personal accounts on lcl.fr?

You may encounter difficulties logging into your LCL Personal accounts on lcl.fr. Here are some tips to resolve the most common problems:

- Check that you have correctly entered your username and password . Pay attention to uppercase letters, lowercase letters and spaces.

- Check that you have a internet connection and that the lcl.fr website is not undergoing maintenance or is down. You can check the service status on the website [touteslespannes.fr].

- Check that your web browser is up to date and accepts cookies. You can access your browser settings in the “Options” or “Preferences” menu.

- If you have forgotten or lost your username or password, you can retrieve them by clicking the “Forgot your username?” or “Forgot your password?” link on the login page. You will then need to enter your account number, date of birth, and postal code. You will then receive an email or letter with your new login details.

- If you have blocked your access to your online accounts after three unsuccessful attempts, you must contact your LCL advisor or call customer service at 09 69 36 30 30 (toll-free call, Monday to Friday from 8am to 10pm and Saturday from 8am to 7pm).

FAQs about LCL for Individuals:

What are the advantages of the LCL Mes Comptes app compared to the lcl.fr website?

The LCL My Accounts app lets you access your LCL Personal accounts from your smartphone or tablet, wherever and whenever you want. You can easily view and manage your accounts, with the same features as on the lcl.fr website. In addition, you can benefit from extra services, such as:

- Geolocation of the LCL branches and ATMs closest to you.

- Scan your checks to deposit them directly into your account.

- Contactless payment with your smartphone using NFC technology.

- Accessing your e-statements and e-documents .

- Access to personalized offers and financial advice.

How do I change my username or personal code to log in to my LCL Personal accounts on lcl.fr?

If you wish to change your username or personal code to log in to your LCL Personal accounts on lcl.fr, you must follow these steps:

- Log in to your customer area on lcl.fr with your current credentials.

- Click on the “My Profile” link in the top right corner of the page.

- Click the “Edit” button in the “My login details” section.

- Enter your new username or personal code in the corresponding fields. Your new username must be 10 digits long and your new personal code 6 digits. You can choose these digits freely, provided they are not too simple or obvious (for example, avoid number sequences like 123456 or birthdates like 01011980).

- Click the “Validate” button to save the changes.

You can also change your login details from the LCL Mes Comptes application, by accessing the “My profile” menu and then the “My details” section.

How do I enable or disable the 3D Secure service to secure my online payments?

The 3D Secure service is a system that enhances the security of your online payments on partner merchant websites. When you make an online purchase with your LCL bank card, you must confirm the payment with a code received by SMS or a push notification on your smartphone. This protects you against fraud and the theft of your bank details. It is recommended not to make payments on any website that does not use 3D Secure .

To activate or deactivate the 3D Secure service, you must follow these steps:

- Log in to your customer area on lcl.fr using your credentials.

- Click on the “My cards” link in the main menu.

- Select the relevant bank card and click the “Manage” button.

- Click on the “Activate” or “Deactivate” button in the “Secure my online payments with 3D Secure” section.

- Follow the on-screen instructions to complete the activation or deactivation of the service.

You can also activate or deactivate the 3D Secure service from the LCL Mes Comptes application, by accessing the “My cards” menu and then the “Secure my online payments” section.

How do I contact my LCL Personal Advisor via lcl.fr?

If you wish to contact your LCL Personal Advisor via lcl.fr, you have several options:

- You can send a secure message to your advisor by clicking on the “My Advisor” link in the main menu, then on the “Send a Message” button. You can attach files if needed. Your advisor will reply as soon as possible.

- You can request an appointment with your advisor by clicking on the “My Advisor” link in the main menu, then on the “Schedule an Appointment” button. You can choose the reason, date, and time of the appointment, as well as the contact method (phone, video call, or in-person at the branch). Your advisor will confirm the appointment by email or text message.

- You can call your advisor directly from lcl.fr by clicking on the “My Advisor” link in the main menu, then on the “Call” button. You will be connected to your advisor or their replacement if they are unavailable. The cost of the call depends on your telephone provider.

You can also contact your LCL Personal Advisor from the LCL My Accounts application, by accessing the “My Advisor” menu and then the “Send a message”, “Make an appointment” or “Call” options.

How to subscribe to an LCL Personal product or service via lcl.fr?

If you wish to subscribe to an LCL Personal product or service via lcl.fr, you must follow these steps:

- Log in to your customer area on lcl.fr using your credentials.

- Click on the “My offers” link in the main menu.

- Select the product or service that interests you from the categories offered (accounts and cards, credit, insurance, savings and investments, etc.).

- Click on the “Subscribe” or “Simulate” button as appropriate.

- Fill out the online form with the requested information.

- Confirm your subscription or simulation by clicking the “Confirm” button.

- Follow the on-screen instructions to complete your subscription or simulation.

You can also subscribe to an LCL Personal product or service from the LCL My Accounts application, by accessing the “My offers” menu and then the product or service categories.

How to open an account with LCL for Individuals?

To open an account with LCL Personal Accounts, you have several options:

- You can apply online at lcl.fr, by filling out a form and choosing the branch closest to you.

- You can make an appointment with an LCL advisor by calling the toll-free number 0 800 400 000 (free call from a landline) or by filling out a form on the lcl.fr website.

- You can go directly to an LCL branch, with a valid identity document, proof of address less than 3 months old and proof of income.

What documents are needed to open an account with LCL Particuliers?

To open an account with LCL Personal Accounts, you must provide the following documents:

- A valid form of identification (national identity card, passport, residence permit…).

- Proof of residence less than 3 months old (electricity, gas, water, landline telephone bill, rent receipt…).

- Proof of income (pay slip, tax notice, bank statement, etc.).

- A bank account statement ( RIB

How do I close an account with LCL Particuliers?

To close an account with LCL Particuliers, you must follow these steps:

- Check that your account is balanced, that is to say that there are no pending or pending transactions (issued cheques not debited, direct debits, standing orders, etc.).

- Send a registered letter with acknowledgment of receipt to your LCL branch, indicating your account number and the desired closing date. You must also include the payment methods associated with your account (bank card, checkbook, etc.).

- Open an account at another bank and transfer your recurring transactions (transfers, direct debits, etc.) there.

- Keep a copy of the closing letter and the final account statement.

What are the fees associated with holding an account at LCL Particuliers?

The fees associated with maintaining an account at LCL Particuliers depend on the type of account you have chosen:

- The basic account: this is an account without a bank card, which allows you to carry out everyday transactions (transfers, direct debits, checks, etc.). It costs €2 per month.

- The service account: this is an account with a bank card of your choice (Visa Classic, Visa Premier, Visa Infinite, etc.), which allows you to benefit from additional services (insurance, assistance, guarantees, etc.). It is charged between €6 and €30 per month depending on the card chosen.

- The customizable account: this is a personalized account that allows you to choose the services you need (bank card, insurance, savings, credit, etc.). It is charged between €2 and €12 per month depending on the options chosen.

You can view the details of the fees associated with holding an account at LCL Particuliers on the website [lcl.fr], in the section "Rates and conditions".

How do I change my contact details in the LCL customer area?

To change your contact details in the LCL customer area, you must follow these steps:

- Log in to your customer area on the website [lcl.fr] or on the LCL Mes Comptes mobile application.

- Click on the "My Profile" menu and then on "My Contact Details".

- Modify the information you wish to change (address, phone number, email address, etc.).

- Confirm your changes by clicking the "Save" button.

You can also contact your LCL advisor to give them your new contact details.

How do I activate or deactivate contactless payment on my LCL bank card?

To activate or deactivate contactless payment on your LCL bank card, you have two options:

- You can do this from your customer area on the website [lcl.fr] or on the LCL Mes Comptes mobile app. Simply click on the "My card" menu and then on "Manage my card". You can then activate or deactivate contactless payment by checking or unchecking the corresponding box.

- You can do this at an LCL ATM. Simply insert your bank card into the reader, enter your PIN, and then select the "Manage my card" option. You can then activate or deactivate contactless payment by following the on-screen instructions.

Contactless payment allows you to pay for purchases under €50 without inserting your card or entering your PIN. Simply hold your card near the payment terminal displaying the contactless logo. It's a fast and secure payment method.

How to block your LCL bank card in case of loss or theft?

If you lose your LCL bank card or it is stolen, you must report it as soon as possible to prevent any fraudulent use. There are several ways to do this:

- You can call the LCL dispute service on 09 69 36 30 30 (toll-free call), available 24/7. You will need to provide your account number and PIN.

- You can call the national card blocking centre on 0 892 705 705 (€0.34/min), available 24/7. You will need to provide the 16 digits of your bank card.

- You can block your card from your online account on the lcl.fr website or the LCL Mes Comptes mobile app. Simply click on the "My card" menu and then on "Block your card". You will need to confirm your request by entering a code received by SMS.

After reporting the loss or theft of your bank card, you must report it to the appropriate authorities (police, gendarmerie, etc.) and request a receipt. You must also notify your LCL advisor so they can issue you a new bank card.

Conclusion

LCL Particuliers is a bank and insurance company that offers services tailored to your needs. To access your accounts and manage your transactions online, you can log in to your customer area on the lcl.fr website or on the LCL Mes Comptes mobile app.